Stated Income Lending

Changing the commercial space, Our lenders/Investors are backed by Wall Street, offering options from 30 year commercial loans, Interests Only, and shorter terms of 5 year, 7 year, and 10 year fixed rates interests only option, Private money is a very important space as you may look for growth and cant get bank funding, Options are not even offered in local banking or the commercial space.

We now have the resources, and support to get deals done as quick as 2-3 weeks up to 30-45 days.

Stated Income Lending

WHERE CAN YOU LEND?

AZ, CA, CO, FL, GA, HI, ID, IL, IN, MA, MD, MI, NC, NJ, NV, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI, and the District of Columbia.

WHAT IS YOUR MAXIMUM LEVERAGE?

We lend in major metropolitan areas.

Our Max LTV will be determined on the location of the property, the borrower's FICO score and experience level.

The Max LTVs are:

80% Purchases

80% Rate & Term

80% Cash Out

WHAT IS THE MINIMUM FICO REQUIREMENT?

The 1-year bridge loan does not have a minimum FICO to qualify. However, the FICO score will directly impact the max leverage.

The 2-year bridge loan has a minimum mid-FICO requirement of 500

The Rental Program has a minimum mid-FICO requirement of 600

WHAT INTEREST RATES CAN YOU OFFER?

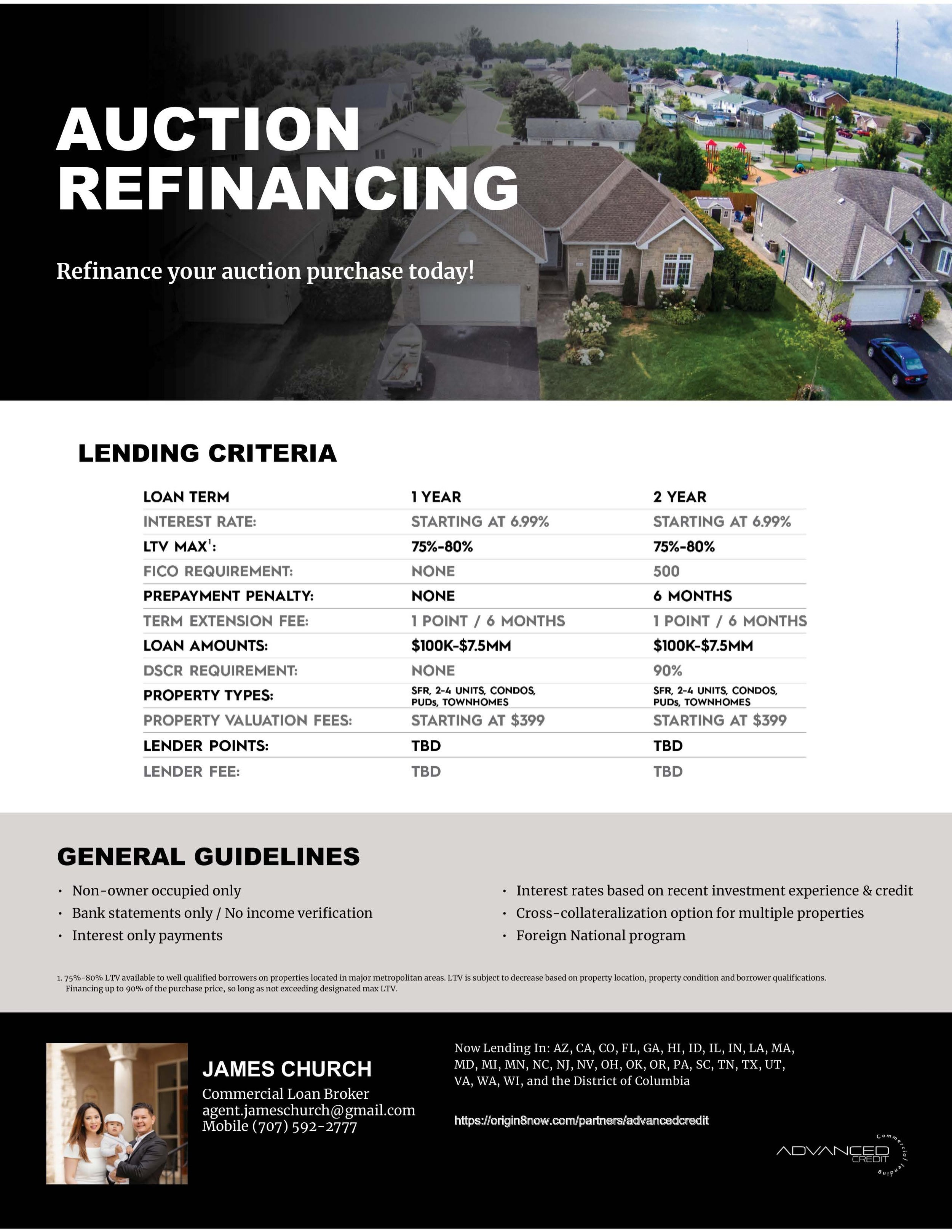

Bridge Loan: Rates start as low as 6.99%.

FICO score, Experience Level, and Vesting Options will directly impact the rate.

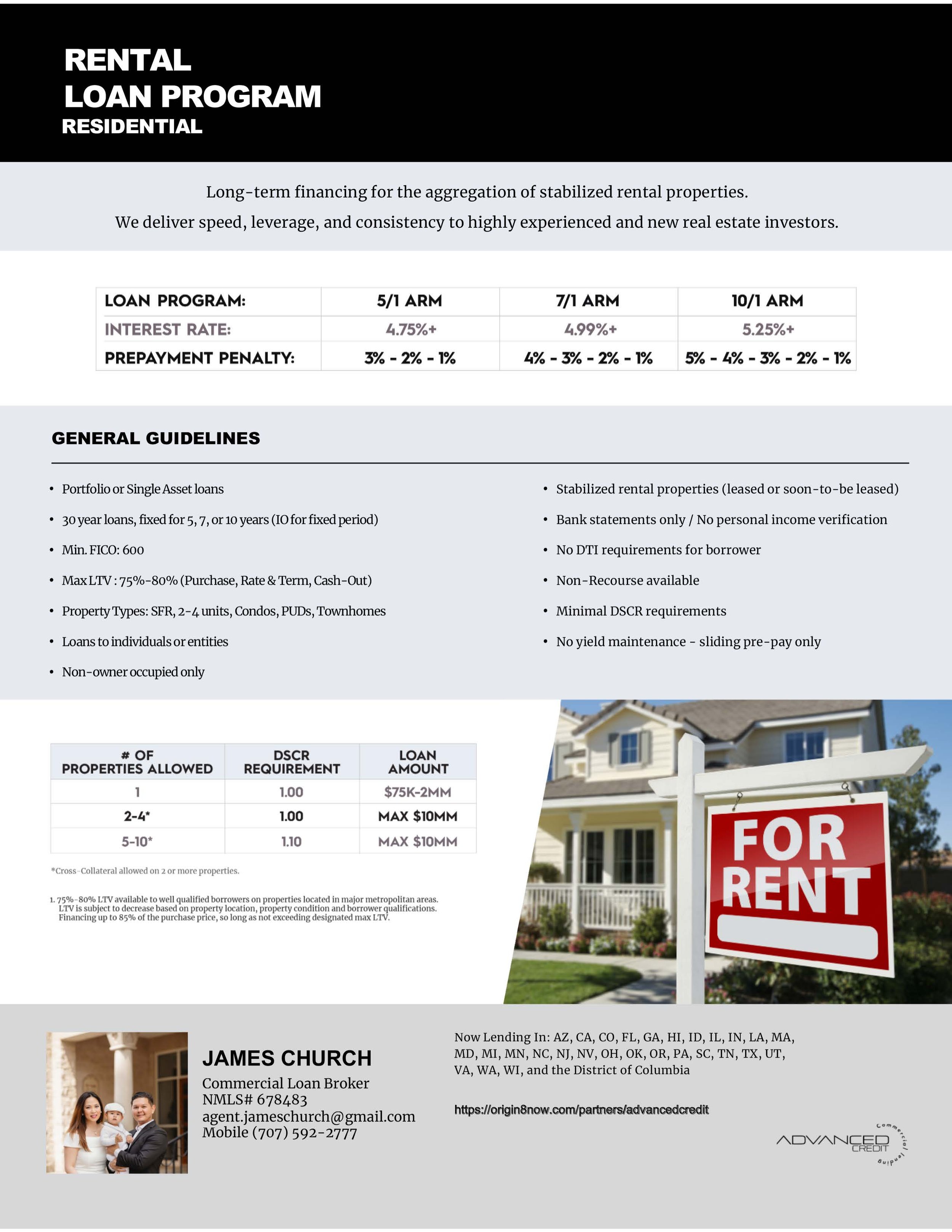

Rental Loan: Rates start as low as 4.75%.

FICO score, Experience Level, and Vesting Options will directly impact the rate.

WHAT ARE THE DIFFERENT VESTING OPTIONS?

Individual(s) name,

Inter Vivos Revocable Trust*

US Legal Entity**

IRA LLC (Checkbook IRA)

*Inter Vivos Revocable Trust vesting are not allowed in Florida

**Vesting as an Individual are not allowed in Georgia. Investor/Sponsor must vest in the name of a legal US Entity (LLC or Inc.)

Florida

Inter Vivos Revocable Trust vesting is not allowed

Georgia

Vesting as an individual is not allowed. Investor/Sponsor must vest in the name of a legal US Entity

Virginia

Vesting as an individual is not allowed. Investor/Sponsor must vest in the name of a legal US Entity

CAN I VEST IN THE NAME OF MY SELF-DIRECTED IRA?

Yes, IRA LLCs (Checkbook IRAs) are eligible investors. The requirements for IRA LLC's are as follows:

The sole member must be a self-directed IRA

The manager must be the IRA holder

Fully Executed Operating Agreement

Borrower Resolution authorizing the IRA LLC to enter into a loan transaction with us

Personal Guaranty must be obtained from the investor/sponsor

Corporate resolution from IRA custodian

WHAT ARE THE DOWN PAYMENT REQUIREMENTS?

The minimum down payment on a purchase is 20%.

The location of the property and strength of the borrower will ultimately determine what the required down payment will be.

WHAT DOCUMENTS ARE REQUIRED TO GET STARTED?

In order to protect your personal information, you can upload the following items directly to our online portal,

Application can be completed in the portal

Driver's License

2 Months Most Recent Bank Statements

Fully Executed Purchase Contract if transaction is a Purchase

Most Recent Mortgage Statement or Payoff Demand if transaction is a Refinance

Entity Documentation for LLC or Inc. if you are vesting in an Entity

Lease Agreement for subject property if you currently already have a tenant in place

Rehab Submission Package and Rehab Budget if rehab financing is requested

Insurance declaration if available

WHAT IS INSTITUTIONALIZED PRIVATE MONEY?

As opposed to Hard Money that does not lend directly and sources its funds from high net worth individuals or crowd funders, Institutionalized Private Money lends directly to the borrower and is backed by Wall Street.

WHAT ARE THE BENEFITS OF INSTITUTIONALIZED PRIVATE MONEY?

There are many reasons an investor would choose to work with a private money lender. Short-term bridge loans are a popular alternative to conventional loans when investors need:

A quick close. Our loans typically close within 7-10 business days.

Time to increase their credit scores to qualify with a Conventional or Non-QM lender

Time to file their tax returns

Also, private money can help investors who:

Are self-employed and cannot qualify traditionally due to their Tax Returns not showing enough income

Have reached the maximum number of loans they can finance traditionally. Here at Advanced Credit we do not calculate DTI, we do not verify income, and we have no cap on the number of investment properties that are financed.

WHAT MAKES YOU DIFFERENT?

We pride ourselves in the experience that we provide to our clients. This starts with our primary portal, Origin8, that allows our clients to enter an application from their desktop or cell phone, safely upload sensitive documentation, view their loan with transparency online, and/or price out a loan scenario.

Compliance

Quick Decision

Here to Help

The 3 Pillars

Experience

Common Sense

Responsiveness

In-House Processing

Simple Terms

Efficiency & Transparency

HOW QUICKLY CAN YOU CLOSE A LOAN?

On average, we close between 7-10 business days. Depending on the complexity of the transaction details and cooperation of all parties involved, fundings can occur as quick as 5 days after a full submission is received or longer than 10 days.

DO YOU OFFER A FORECLOSURE BAILOUT PROGRAM?

We do not offer a Foreclosure Bailout Program. No active Foreclosures or Bankruptcies will be considered.

DO YOU OFFER BLANKET LOANS / CROSS-COLLATERALIZATION?

Yes, we offer and specialize in blanket loans. We can have up to 10 properties in one loan. All of the properties will have to be in the same state.

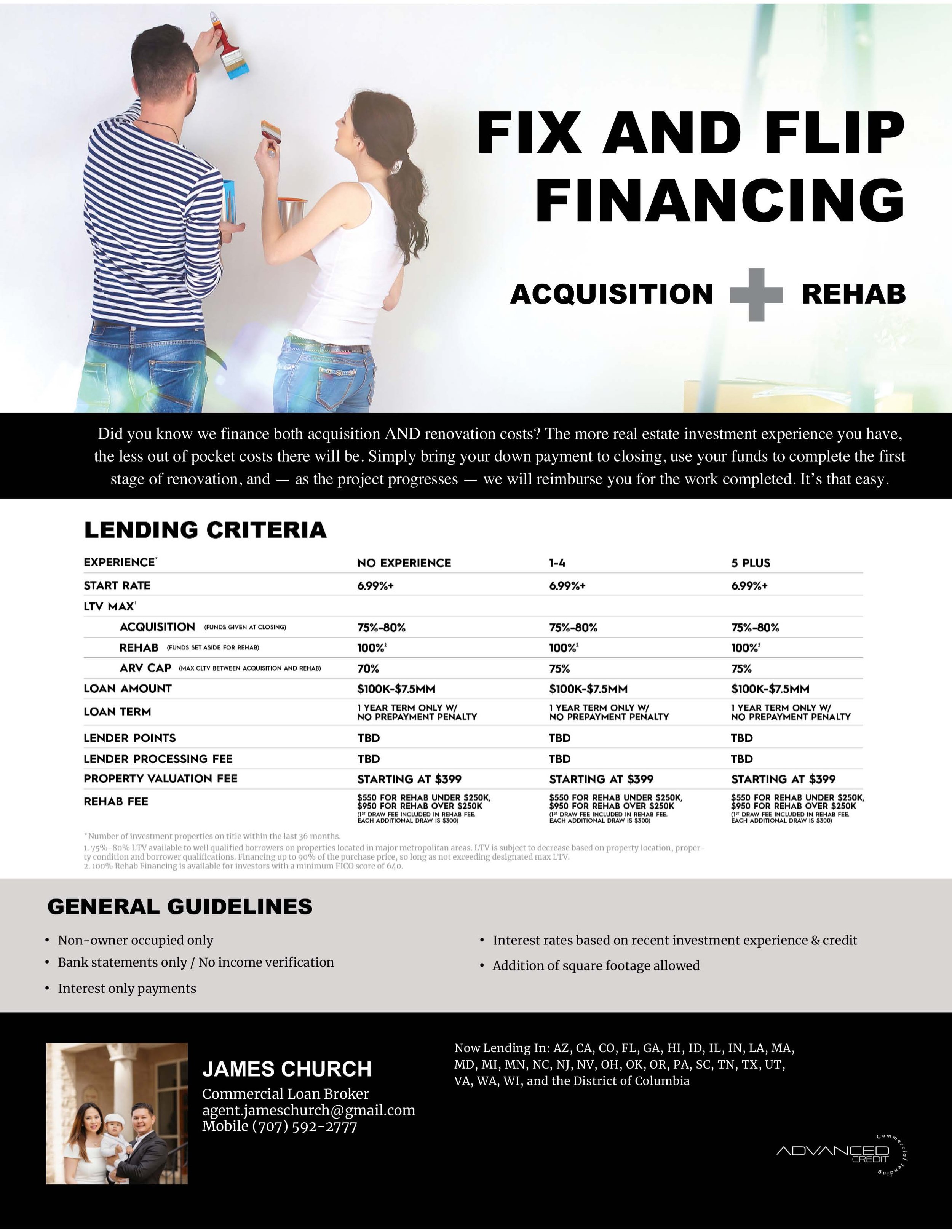

DO YOU FINANCE REHAB? IF SO, HOW MUCH?

Yes, we offer rehab financing up to 100% of the rehab budget. The amount financed is determined by the borrowers level of experience and will range between 80%-100% of the rehab budget. These funds will be disbursed from a holdback account on a draw schedule.

DO WE LEND ON THE ARV?

No, our lender is an As-Is Lender. When we finance the rehab along with the acquisition of the subject property, we use the AS-IS value to determine the base loan amount and leverage. The base loan amount plus the rehab financing amount is all on the same note, and that total loan amount may not exceed 70-75% of the ARV.

WHAT PROPERTY TYPES CAN WE LEND ON?

Residential Investment Properties: Attached and Detached SFR, 2-4 units, Townhomes, Condos, Manufactured and Modular homes, and Multifamily apartments.

DO WE OFFER GROUND-UP CONSTRUCTION FINANCING?

No, currently we do not offer ground-up construction financing

DO WE LEND ON COMMERCIAL PROPERTIES?

The only commercial property that our lender currently lends on is Multifamily properties up to 100 units.

DO WE LEND ON VACANT LAND?

No, currently we do not offer financing on vacant land

CAN WE LEND TO FOREIGN NATIONALS?

Yes, we also lend to Foreign Nationals. The requirements are:

Valid ITIN Number

Valid EIN Number if vesting in an entity

Current and valid Passport of Country of Origin

Current and valid VISA

Funds used for transaction to come from a US bank account

WHY DOES THE LENDER ASK FOR BANK STATEMENTS?

Bank Statements are a crucial item needed to help determine whether the borrower has sufficient funds to cover the down payment and closing costs needed to complete the transaction. Also, because we do not verify income, we require that the borrower has additional funds to cover a minimum of 4 months of the payment including their interest only payment, taxes, insurance, and Association dues, if applicable

DOES THE LENDER REQUIRE ADDITIONAL RESERVES FOR QUALIFICATION?

Yes, its part of the risk layering procedure is the requirement of reserves. We are a Stated Income Lender; therefore, we require that the borrower has additional funds to cover at least 4 months of the payment including their interest only payment, taxes, insurance, and Association dues, if applicable

WHAT ALTERNATE DOCUMENTATION OTHER THAN BANK STATEMENTS CAN I PROVIDE TO MEET THE RESERVE REQUIREMENT?

Although the full balance will not be used for qualification of the reserve requirement, We will also consider retirement assets and brokered accounts on a case-by-case basis.